Giving

Give to the Seton Family of Catholic Schools

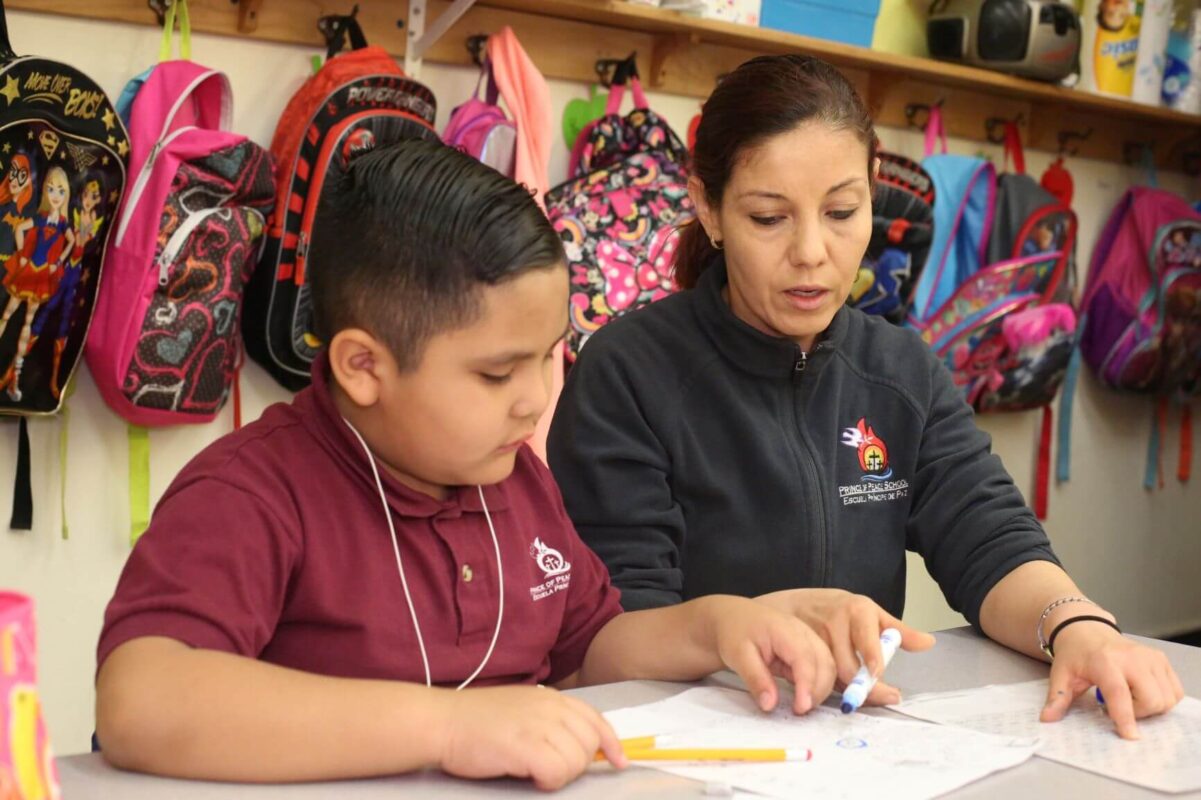

Our mission of providing high quality Catholic education to urban Catholic schools in Greater Milwaukee would not be possible without the generosity and dedication of our donors. We are deeply grateful on behalf of our students, their families and neighborhoods!